What is VeriFactu and the Antifraud Law and why is it important to comply?

The Antifraud Law mandates that all invoices from companies and freelancers in Spain are generated with adapted software that ensures their integrity and traceability, approved by the Tax Agency and compatible with VeriFactu.

Complying provides security and transparency and avoids legal and financial issues.

Ensure compliance

Avoid problems and penalties and ensure you comply with current regulations.

Automate processes

Forget about manual adjustments; your invoices are sent and reported automatically.

Total security and control

Immutable, traceable, and auditable invoices according to VeriFactu standards.

Comply with VeriFactu and optimize your invoicing

Nominalia helps you transition to legal, agile, and centralized invoicing.

Other benefits of B2Brouter

International reach

Connection with electronic exchange networks in multiple countries

International reach

Connection with electronic exchange networks in multiple countries

Guaranteed security

Data protection and technical compliance.

Guaranteed security

Data protection and technical compliance.

Intuitive use

User-friendly interface with advanced functionalities.

Intuitive use

User-friendly interface with advanced functionalities.

Multi-format

Process and convert documents to various formats.

Multi-format

Process and convert documents to various formats.

We have a B2Brouter plan for you

Choose the one that best suits your business needs and start with your e-invoicing.

Basic (Gratis)

To start with e-invoicing and VeriFactu

0 €

FOREVER

1 user per account

Up to 10 contacts

Up to a maximum of 24 transactions per year with VeriFactu

Spain only

Professional (-20%)

For businesses with

low or medium invoicing

7.33 €/month

9.17 €/month

2 users per account

Unlimited contacts

Unlimited sending and receiving of invoices via VeriFactu

Inside and outside Spain

Quotes and credit notes

Recurring and simplified invoices

Attach documents to your invoices

SEPA bank transfers

Business (-20%)

For businesses with

more advanced processes

20.00 €/month

25.00 €/month

10 users per account

Unlimited contacts

Unlimited sending and receiving of invoices via VeriFactu

Inside and outside Spain

Quotes and credit notes

Recurring and simplified invoices

Attach documents to your invoices

SEPA bank transfers

Legal Invoice Archive

Sending Other Documents via VeriFactu

Contact Import

Product and Service Catalog

Custom SMTP Server Configuration for Invoice Sending

Are you a Nominalia client? Activate your free account here

Frequently Asked Questions about VeriFactu and B2Brouter

-

What is VeriFactu?

VeriFactu is a system approved by the Spanish Tax Agency (AEAT) for issuing, receiving, and managing electronic invoices. Its main goal is to ensure that invoices are unalterable, auditable, and generate an automatic record in the tax administration systems.

-

Who is required to comply?

Currently, electronic invoicing is mandatory only for billing to the Public Administration. Starting in 2027/2028, it will also be mandatory for transactions between businesses and freelancers.

B2Brouter is adapted to the VeriFactu system so you can meet the requirements from day one without changing tools. -

How does Nominalia + B2Brouter help me comply with regulations?

With B2Brouter, you can generate legal, secure, and VeriFactu-compliant invoices, send records directly to the AEAT, and work with both public and private clients. Nominalia will assist you in activating it easily.

-

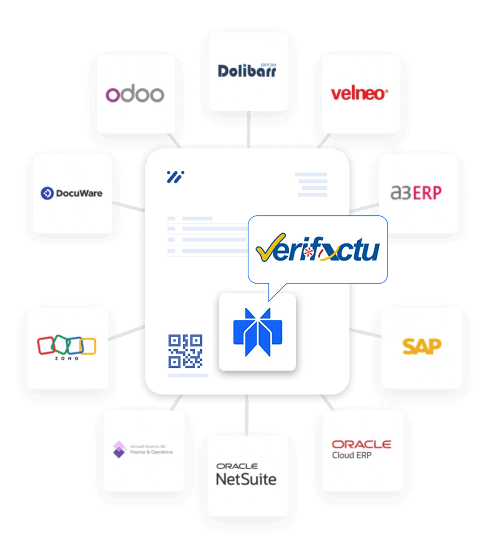

Do I need to change my current software or ERP?

Not necessarily. You can integrate B2Brouter via API to continue using your usual system or manage it directly from the platform. It also allows national and international invoicing in multiple formats.

-

How can I get started and what support will I receive?

You can activate it from Nominalia in just a few minutes and try it for free. You will have specialized support from B2Brouter and priority technical assistance to ensure a quick and hassle-free adaptation.

Do you need advice on electronic invoicing?

Use the chat, call, or write to us.

-

Click the icon you see above

We will respond in real-time -

93 288 40 62

Call us from Monday to Saturday, from 9:00 to 19:00.

Sundays and holidays from 10:00 to 18:00.

-

Request support

from your Client Zone